The Cola wars within the Nigerian context

Introduction

The intense rivalry between carbonated soft drinks (CSD) giants, Coca Cola and Pepsi is the stuff of legends.

Pepsi fired the first salvo more than 40 years ago, when it challenged its more established competitor in a taste contest that forced Coke to naively alter its winning formula and launch ‘New Coke’. Pepsi won this first round, as Coke got a backlash by loyal coke fans and were forced to re-evaluate their decision.

Ever since this near-disaster- at least for coke, both brands have been engaged in a head-to-head battle that has now become part of our global culture.

Both brands have dominated the Nigerian market in value and volume, yet analysts constantly debate what really drives consumer preferences.

The Loyalists Perspective

PepsiCo and Coca-Cola have spent billions of dollars over the years to build dynamic and vibrant brands, with both brands boasting a huge global customer base.

Coca Cola lovers argue that the feeling of a chilled bottle of Coke is second to none. For many, it’s a distinct feeling of sheer “happiness”, a position that Coca Cola’s has nurtured over the years.

Beneath the volumes of fizzy bubbles is the underlying message of “if you want to be happy, drink Coke”. This brand message taps right into the most desired want of humanity, evoking emotion and making an instant connection with consumers over its competitors.

Pepsi, on the other hand, is slightly different. The brand anchors its core strategy on music and entertainment, occasionally releasing taglines that reinforce its “challenger” archetype. For Pepsi, just as music refreshes the soul and mind, the sweet and subtle taste of Pepsi guarantees total refreshment for its loyal customer base.

In Nigeria, both brands have evolved in almost every respect. Whilst Coca Cola continues to adopt a global marketing strategy, Pepsi deeply embeds itself in the local communities to which it is present, a strategy that allows it respond faster than coke to the ever-changing demands of its customers.

The Big Cola & Bigi Conundrum

As the battle for “Cola Supremacy” in Nigeria raged on, it appears that both brands momentarily lost track of the evolving needs of its teeming fans.

Just before Nigeria’s economic meltdown between 2015 and 2017, two new ambitious players entered the cola market, with a simplified offering and clear focus on delivering more value for lower prices. Big Cola and then Bigi quickly began to attract a new base of recession impoverished Nigerians that still needed a “refreshing cola experience”.

For a number of retailers in Lagos, Bigi in particular quickly gained ground on its cola competitors, stealing a march on its global rivals with an aggressive pricing regime. With over N30 billion worth of investment already down, Bigi has doubled production capacity to capture a large share of the Carbonated Soft Drinks segments.

“We like coke o, but it is too expensive. Our customers do not like to buy one bottle of 50cl Coke for N150 when 50cl Pepsi is N100. Our customers rather buy 60cl Bigi for N100. They feel that they are getting more value for their money” said a distributor for Coke, Pepsi and Bigi.

But as price reduction is never a useful strategy for long term differentiation or business growth, the great cola giants responded, triggering a new dimension in the cola wars in Nigeria

The Great Price War

When the recession hit in 2016, both brands hiked the prices of their 50cl bottles to N150 to cover losses in foreign exchange variations, but both faced instant backlash.

Pepsi was first to respond by launching its brilliant “Things I Long Throat For” campaign, introducing the 60cl Pepsi “long throat” bottle. This new product was 20% more than the previous Pepsi bottle and priced at just N100, consumers more value for their money.

The campaign which was driven by the brand’s ambassadors (Wizkid, Tiwa Savage & Seyi Shay) generated a significant buzz on social media, trending for weeks with customers posting, tweeting and retweeting.

Unsurprisingly, Coca Cola responded in February 2016, slightly later, with the release of its own 60cl pet bottle. The company also unveiled the ‘Solo or Bigger Boy’ campaign, offering its customers a choice between the 60cl bottle at N150 and the 35cl bottle at N100. With massive advertising and publicity and because the bottle was so innovative, Coke appeared to regain some ground.

While Coca-Cola was celebrating the launch of its new bottle, Pepsi retaliated with a price reduction campaign tagged, “No Shaking, Carry Go” offering customers the 50cl Pepsi bottle at N100. With no plans to slow down, Pepsi aggressively promoted this new offering across a few key markets. This campaign received a lot of radio airtime as well as massive promotional activities across its key locations.

Just as market analysts believed we were entering a season of relative calm in the cola price wars, Coca Cola launched its ‘Mama di Mama’ campaign, unveiling the ‘Mama’ 1 Litre bottle at the retail price of N200.

We can only begin to imagine what new invention the guys at PepsiCo are cooking up to counter this new onslaught.

Taking It Global

On the global scene, these two cola brands continue to charm the world with brilliant marketing and advertising campaigns.

Coca Cola has managed to humanise its brand over the years, owning large swathes of the holiday market owing to the brilliance of its 1930’s commercial creating a strong visual for the “Santa Claus” the world recognizes today.

Adding innovation to its product mix, Coke’s “Taste the Feeling” and “Share a Coke” campaigns had everyone around the world scrambling to get their names on the face of a coke bottle, and by 2018 Coke had increased global market share significantly.

Coca Cola also hinges its brand sustainability efforts of strong corporate investments within the markets it operates. Clear CSR programs have helped the brand maintain a strong competitive advantage

PepsiCo, on the other hand, has remained true to its music and entertainment heritage, endorsing global music superstars, athletes, and influencers. Indeed, music remains a part of Pepsi’s heritage, a key instrument for the brand, and its global appeal is strengthened across borders through the clever adoption of pop culture and entertainment in its marketing efforts.

Social Media

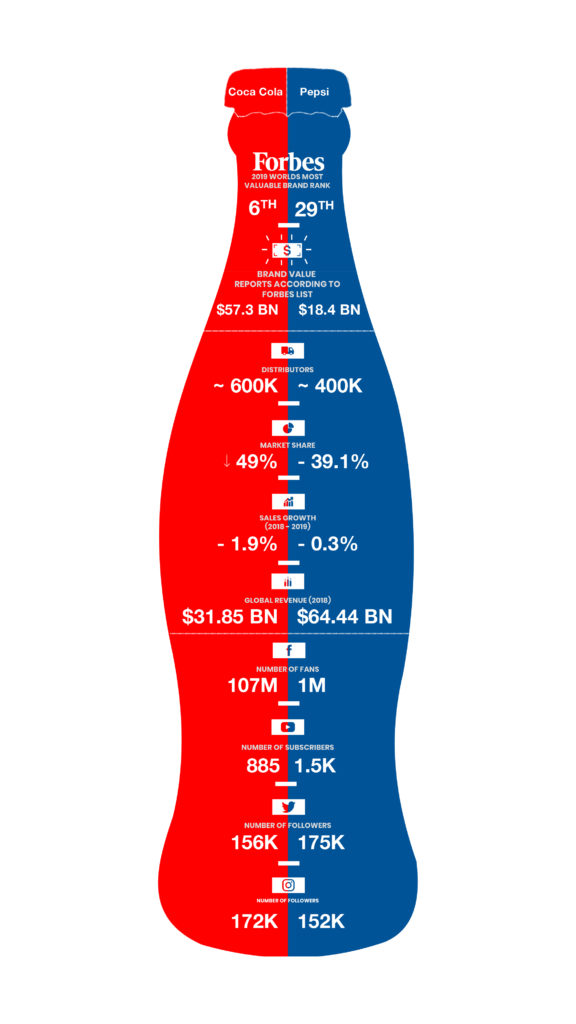

On Facebook, Coca-Cola Nigeria welcomes 107.4 million fans, while Pepsi Nigeria has slightly over 1milllion fans on its official page which isn’t enough to compete with Coke.

However, Pepsi Nigeria’s Twitter account boasts a following of 175,000 followers compared to Coke’s 154,000 followers.

On Instagram, things get a bit more exciting as Coke comes back on top with a following of 173,000 whilst Pepsi has 152,000. It is worth mentioning that both Coke and Pepsi are social media leaders, however, the clarity, consistency, and content quality maintained on their global platforms is not translated to their Nigerian pages.

Locally for both brands, it seems as if there is no clear content strategy to drive the core brand message across their social media platforms.

Based on statistics alone, both brands clearly have a huge following on the different platforms, and each brand works hard to increase and maintain their following. Coke’s value of family and community are well represented, while Pepsi’s energy and use of celebrity shine through.

But, evidenced through its Facebook and Instagram accounts, Coke clearly holds an advantage and wins on social media because Coke has a larger audience, in terms of activity and engagement. For social media there is a clear winner but the rest is up to your taste buds.

Conclusion

In spite of the decline in the sales in Nigerians 2018, Coca Cola still outperforms Pepsi and all other cola beverages, across virtually all financial indicators.

However, its global-to-local marketing operations leaves it vulnerable to Pepsi, whose localised strategy allows it respond faster to the threat of much smaller and more agile brands.

While the jury remains out on the winner of the cola wars globally, we’ll cede this round to both Bigi and Big Cola, for daring to challenge a duopoly that has existed for more than 40 years within the Nigerian environment.